NEWS CENTER

2020-07-27 Golden Weekly EU's huge spending plan and international tensions intensify "spot gold breaks through US$1,900"

2020-07-27

◆ Content summary:

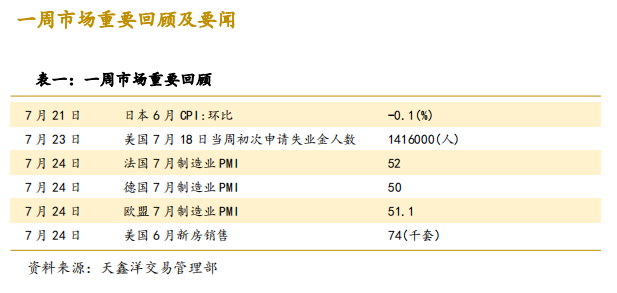

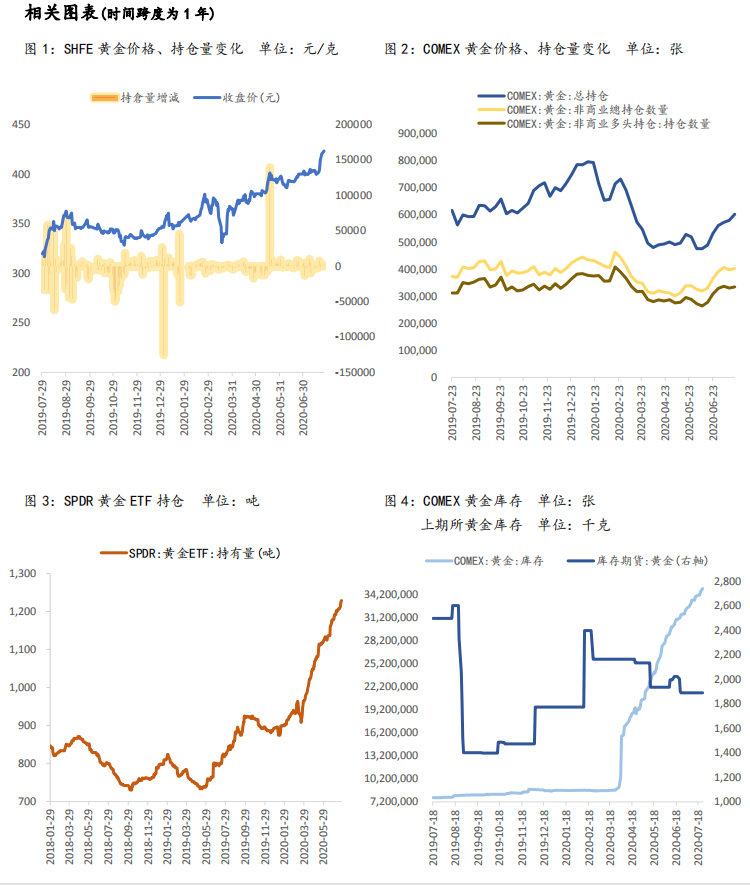

Gold rose sharply last week, and London Gold has now closed at US$1900.06/ounce, with an amplitude of 5.63%, and hitting a maximum of US$1906.88/ounce. The latest data released by the US Commodity Futures Trading Commission (CFTC) showed that COMEX gold non-commercial total holdings decreased and net longs decreased. As of the week of July 21, non-commercial net longs increased by 4,008 lots to 266,436 lots, an increase of 1.53%; SPDR recently Holding positions increased by 21.92 tons to 1,228.81 tons.

On the evening of July 24, spot gold exceeded $1,900 per ounce. Since the beginning of this year, gold has risen by as much as 25%, and hit a new high on the evening of the 24th, just one step away from the historical high of 1921.15 US dollars formed in 2011. At the EU leaders summit in Brussels, the parties have been fighting fiercely to reach an agreement on a huge spending plan. As the negotiations continued to the fourth day, the EU Recovery Fund of 750 billion euros had a new compromise for leaders to discuss. The copy of the draft obtained by the agency shows that in the new EU Recovery Fund plan announced by the President of the European Council Michel last Monday, the funds distributed in the form of gratuitous grants were 390 billion euros, which was lower than the original plan of 500 billion euros, and another 360 billion euros. 100 million euros will be issued in the form of low-interest loans. In addition, the market expects that the US government will launch a new round of fiscal stimulus to push up the price of gold. In addition, the turmoil in the international political situation has also triggered a further rise in the price of gold. British Foreign Secretary Raab officially announced last Monday that the United Kingdom The extradition treaty with Hong Kong will be suspended "immediately and indefinitely" and an arms embargo will also be imposed on Hong Kong. In the United States, the Treasury Department announced the addition of 11 companies to the list of entities as a response to China's handling of the Xinjiang Uyghur issue.

◆ Conclusions and suggestions:

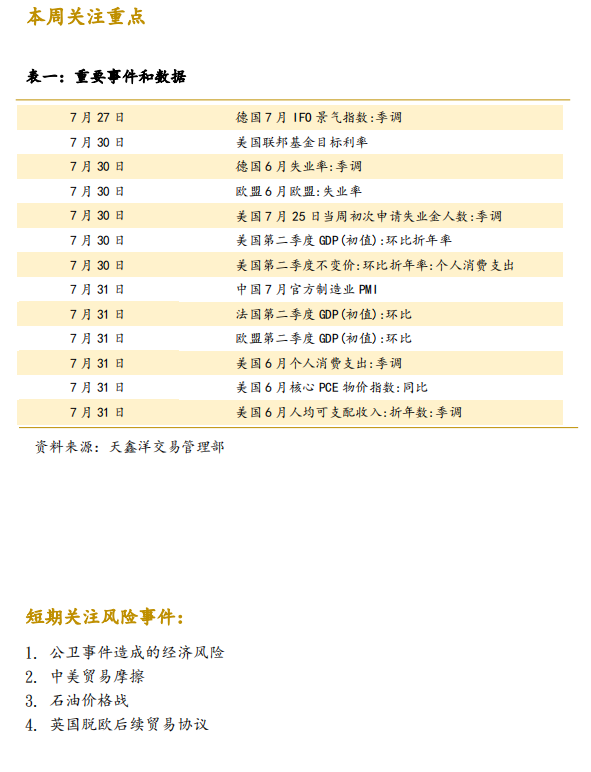

The popularity of gold is currently rising exponentially, and the enthusiasm for gold has spread to the streets of the United States. With the help of retail investors, gold-backed ETF assets are expected to rise for the 18th consecutive week, the longest consecutive rise since 2006. The reason lies in all inflation factors: the yield curve, printing money, concerns about the economy and the new crown pneumonia. Politicians decided to implement an unprecedented stimulus package; central bank governors decided to print money at an unprecedented speed to fund these expenditures; US inflation-adjusted bond yields fell to negative; and the sudden depreciation of the dollar against the euro and the yen . The price of gold is expected to fluctuate around US$1,920 per ounce this week, and London gold is currently operating in the range of US$1872-1921 per ounce.

Market news last week

1. Britain announced the suspension of the extradition treaty with Hong Kong and will impose an arms embargo on Hong Kong

The United Kingdom announced on Monday that it would suspend its extradition treaty with Hong Kong because of the escalating tension between the United Kingdom and China over Hong Kong’s new national security law. In a speech in the House of Commons last Monday, British Foreign Secretary Dominic Raab announced that Britain will “immediately and indefinitely” suspend its extradition treaty with Hong Kong. Raab said in announcing this move in the House of Commons that Britain "wants to establish a positive relationship with China." But he said that the Chinese government’s implementation of the new national security law in Hong Kong is a “serious breach” of the country’s international obligations. Raab also confirmed that the government will extend the arms embargo (which has been imposed on China since 1989) to Hong Kong to prevent Britain from exporting weapons, smoke bombs, and shackles to the region.

In this regard, Chinese Foreign Ministry spokesperson Wang Wenbin stated at a regular press conference on the 20th that the UK’s recent erroneous remarks and measures concerning Hong Kong ignore the basic facts that Hong Kong’s national security law contributes to the stability and long-term development of “one country, two systems”. Violating international law and basic norms of international relations, grossly interfering in China's internal affairs. China strongly condemns this. The Chinese side urges the British side not to go further and further down the wrong path, so as not to cause further damage to Sino-British relations.

Recently, the relationship between China and the United Kingdom has continued to deteriorate in many ways. The previous decision by the United Kingdom to prohibit the Chinese technology giant Huawei from entering the country’s 5G network has further intensified this relationship.

2. The EU reached an agreement on a 750 billion euro economic recovery fund

Last Tuesday (21st) the EU leaders reached a consensus on the EU Economic Recovery Fund stimulus plan. According to the agreement, the EU will issue 750 billion euros (approximately US$860 billion) of joint bonds, the largest borrowing in EU history to help the EU. Overcome the economic shock caused by the new crown epidemic. According to the agreement, the EU Economic Recovery Fund will issue 390 billion euros of bailout to EU member states, the bailout does not need to be repaid, and the remaining 360 billion euros will be low-interest loans.

It is worth noting that nearly one-third of the fund will also be used to combat climate change. It will run in conjunction with the next European Union’s 1 trillion euro seven-year budget. This will constitute the largest green stimulus plan in history. It needs to meet the greenhouse gas emission reduction targets set in the Paris Agreement. According to the agreement, the EU Economic Recovery Fund will provide strong financial support to the southern European countries that have been hit hardest by the epidemic. This also shows that the EU is showing true unity if necessary. The previous EU Economic Recovery Fund and EU countries could not reach a consensus because the original proposal was 500 billion US dollars in aid, but it was opposed by thrifty countries such as the Netherlands and Austria, and finally last Tuesday (21st) EU countries reached an agreement , The bailout was reduced to 390 billion euros.

Wechat Public Account

Mobile Site

COPYRIGHT©2020 Chengdu Tianxinyang Gold Industry Co., Ltd. Power by 300.cn

川公网安备 51010502011525号