NEWS CENTER

2020-08-03 Golden Weekly Report, the Fed maintains easing guidance, gold trading becomes more and more crowded

2020-08-03

◆ Content summary:

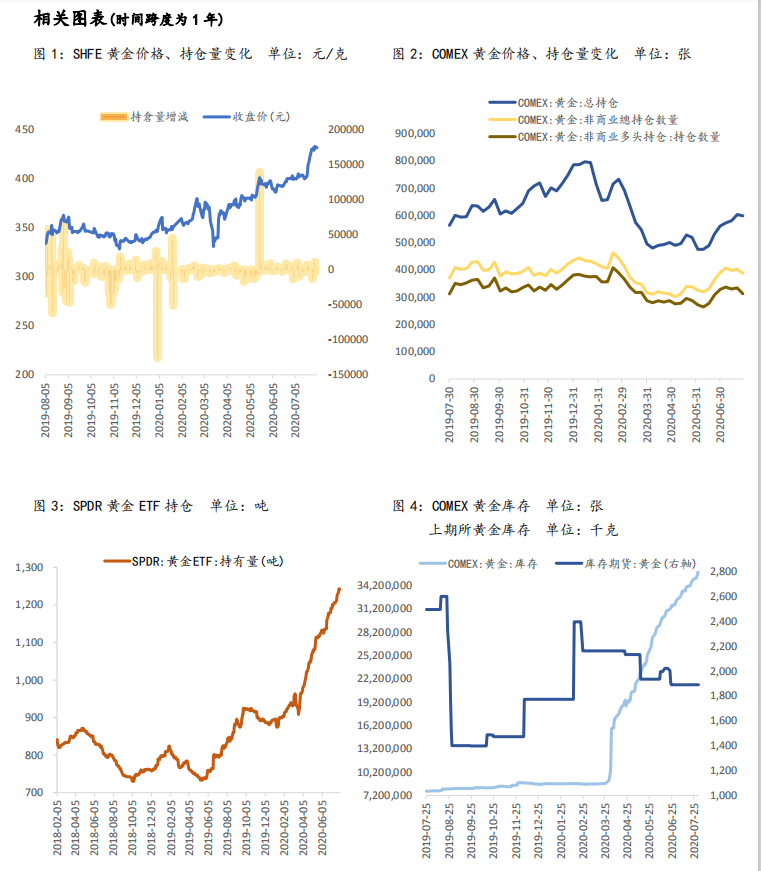

Last week, gold rose, London gold closed at 1974.90 US dollars/ounce, with an amplitude of 4.48%, and the highest hit 1984.22 US dollars/ounce. The latest data released by the US Commodity Futures Trading Commission (CFTC) showed that the total non-commercial positions of COMEX gold decreased and the net long position decreased. As of the week of July 28, the non-commercial net long position decreased by 29,635 lots to 236,801 lots, a decrease of 11.12%; SPDR The recent holdings increased by 13.14 tons to 1,241.95 tons.

In the early morning of July 30, the US Federal Reserve announced that it would maintain the target range of the federal funds rate between zero and 0.25%, which was in line with market expectations. The Fed also reiterated that the prospects of the US economy will largely depend on the development of the new crown epidemic. In response to the news that the Fed’s interest rate remained unchanged, the external market generally reacted: the U.S. dollar index fell sharply by 0.44%, and the index hit a new low since late June 2018; the three major US stock indexes rose moderately, while European stocks rose or fell slightly ; Commodities such as copper rose slightly, and futures and spot gold hit record closing prices. International crude oil futures continued to adjust horizontally and closed slightly higher.

Fed Chairman Powell said at a press conference that day that the outlook for the US economy is full of uncertainties and that the economic outlook will largely depend on whether the epidemic can be successfully controlled. In recent weeks, the number of confirmed cases of the new crown in the United States has increased, and new measures to control the spread of the epidemic have begun to put pressure on economic activities. To support the economic recovery, the Federal Reserve pledged to use all credit and liquidity tools. At the same time, fiscal policy is also very important and will play an irreplaceable role.

◆ Conclusions and suggestions:

Fed policymakers once again promised to use "all-round tools" to support the economy and maintain interest rates close to zero until the impact of the epidemic passes. At the press conference, Powell emphasized the impact of the epidemic on the delayed recovery, emphasized the risk of permanent damage to the economy caused by corporate failures, and reiterated that the Fed did not consider raising interest rates. This series of statements can prove that the Fed's next policy will be The trend continues to be dovish, but the only tool that has not been considered so far is negative interest rates. Looking to the future, the Fed's policy largely depends on the economic trend. The Fed has provided a certain degree of forward-looking guidance in its forecast last month, which indicates that most officials have not expected to raise interest rates for many years. Gold prices are expected to fluctuate around 1995 US dollars/ounce this week, and London gold is currently operating in the range of 1900-2030 US dollars/ounce.

Market news last week

1. The Fed's July interest rate meeting maintains its easing orientation as expected by the market

The Federal Reserve maintained its benchmark interest rate in the range of 0%-0.25%, while keeping the excess reserve interest rate (IOER) unchanged at 0.1%, basically in line with the market range. Previously, CME predicted that the probability of maintaining this interest rate range from 0% to 0.25% is 100%.

In terms of open market operations, the Fed maintained the exact same qualitative statement as in June, making it clear that it will continue to increase its holdings of US Treasury bonds and MBS at least at the current rate in the coming months. In other words, the Fed will continue to increase its holdings by about US$120 billion per month in the future, which is consistent with the open market operation plan disclosed by the Fed recently. The New York Fed disclosed on the 27th that it will purchase US$80 billion of Treasury bonds from July 14 to August 13, of which the largest purchase in the next two weeks is about US$40 billion; from July 28 to August 13 it will purchase US$61.8 billion in MBS . In terms of economic outlook, the Fed basically maintained the same judgment as in June, believing that public health events will severely affect economic activities in the short term, and added that “the future economic path will largely depend on the evolution path of the epidemic.”

In addition, the Federal Reserve also announced that it will extend the central bank's currency swap arrangement to March 2021, and the extension will apply to all 9 central banks in the previous agreement. Prior to this, the Fed's central bank swap scale had contracted by more than US$327 billion for eight consecutive weeks. Under the current background that US dollar liquidity remains basically normal, the sequel to this mechanism implies the Fed's willingness to increase liquidity support.

Wechat Public Account

Mobile Site

COPYRIGHT©2020 Chengdu Tianxinyang Gold Industry Co., Ltd. Power by 300.cn

川公网安备 51010502011525号