NEWS CENTER

2020-07-20 Golden Weekly Gold price is close to historical highs, capital profits flee or pressure gold prices

2020-07-20

◆ Content summary:

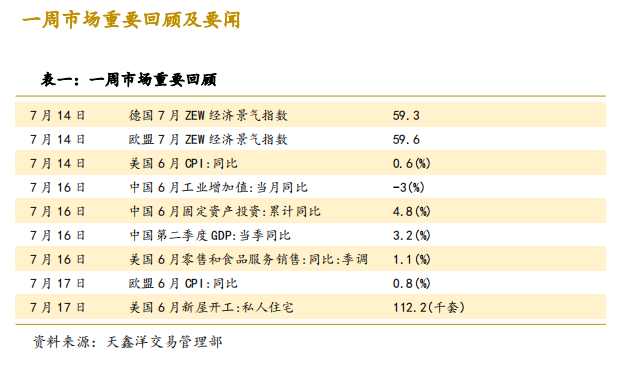

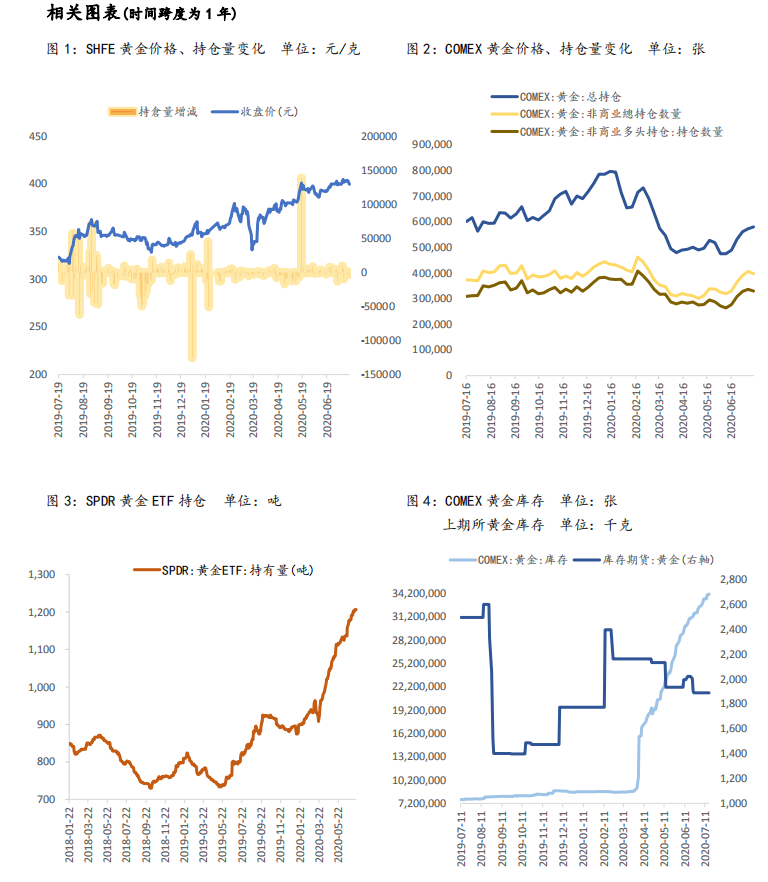

Gold rose last week, and London Gold has now closed at US$1808.90/ounce, with an amplitude of 1.40%, reaching a maximum of US$1815.06/ounce. The latest data released by the United States Commodity Futures Trading Commission (CFTC) showed that COMEX gold non-commercial total holdings decreased and net long positions decreased. As of the week of July 14, non-commercial net long positions decreased by 4,930 lots to 262,428 lots, a decrease of 1.84%; SPDR The recent holdings increased by 6.43 tons to 1,206.89 tons.

The latest report of the World Gold Council (WGC) shows that affected by factors such as the new crown pneumonia epidemic, international gold prices, which have been hovering near historical highs, will continue to be supported in the near future. The world's largest gold ETF fund SPRD's holdings did not exceed 1,000 tons after 2013, but in mid-April this year, the data returned to more than 1,000 tons and continued to rise. Data shows that as of July 13, SPRD gold ETF holdings amounted to 1,203.97 tons, a significant year-on-year increase of 50.3%.

◆ Conclusions and suggestions:

In response to the shock caused by the epidemic, central banks around the world have sharply cut interest rates or expanded asset purchase plans to stabilize and stimulate their own economies. However, these actions are having some unexpected effects on asset performance. The first is the soaring stock market valuation, but this is not necessarily supported by fundamentals, thus increasing the possibility of a stock market correction; the second is that corporate bond prices are also rising, further depressing the credit quality curve; the third is short-term and high-quality bonds With limited upside space, its hedging effect has declined.

However, a number of market indicators have shown the formation of speculative bubbles in the gold market, and unscheduled capital profit flight may put pressure on gold prices. In the last bull market for more than 10 years of gold, the historical high of the price of gold was $1921.15 per ounce in 2011. The price of gold is now at an absolute high in history. Gold prices are expected to fluctuate around US$1815/ounce this week, and London gold is currently operating in the range of US$1785-1835/ounce.

Market news last week

1. The World Gold Council publishes its second half year outlook

The World Gold Council’s second-half outlook report issued on the 15th stated that the market’s expectations for the recovery speed of the global economy are declining, which will continue to strengthen the role of gold as a strategic asset; and the three major factors are high risk, low opportunity cost and positive price potential. Factors will support gold investment and offset the weak demand on the gold consumer side caused by the economic contraction. However, data released by the World Gold Council show that gold investment is hot. In June, the global gold trading open-end index fund (gold ETF) net inflow was 104 tons, and the total global gold ETF holdings reached 3,621 tons, a record high.

The report pointed out that regardless of a V-shaped, U-shaped or W-shaped economic recovery, the epidemic is likely to have a sustained impact on asset allocation. Although the global stock market has rebounded sharply from the low point in the first quarter, the high degree of uncertainty caused by the epidemic and the ultra-low interest rate environment are still driving the strong flow of safe-haven funds to safer and higher-quality assets. The record inflow of gold ETF funds further highlights its hedging effect. The world's largest gold ETF fund SPRD's holdings did not exceed 1,000 tons after 2013, but in mid-April this year, the data returned to more than 1,000 tons and continued to rise. Data show that as of July 13, SPRD gold ETF holdings amounted to 1,203.97 tons, a significant year-on-year increase of 50.3%.

In years where the inflation rate is higher than 3%, the price of gold rises by an average of 15%. It is also worth noting that the Oxford Institute for Economic Research has shown that gold should perform well in a period of deflation. These periods are characterized by low interest rates and high financial pressures, both of which tend to push up gold demand. In the current global economic environment, gold investment demand is supported by three: high risk and high uncertainty, low opportunity cost, and positive price potential. But the report also pointed out that the economic contraction may depress gold jewellery consumption, demand for technology gold or long-term savings demand.

The report expects that in the second half of this year, China will accelerate the growth of money supply (M2) and the scale of social financing through various tools such as lowering the deposit reserve ratio and benchmark policy interest rate. With the rapid increase in the money supply, the role of gold as a hedge against currency depreciation may become more important to investors. In addition, although the cautious consumption of non-essential goods may continue to hit the sales of gold jewellery, as the economy recovers, these unfavorable factors may be relieved to some extent.

Wechat Public Account

Mobile Site

COPYRIGHT©2020 Chengdu Tianxinyang Gold Industry Co., Ltd. Power by 300.cn

川公网安备 51010502011525号