NEWS CENTER

2020-07-13 Golden Weekly Report, the epidemic situation is still severe, the price of gold exceeds the important mark of 1,800 US dollars

2020-07-13

◆ Content summary:

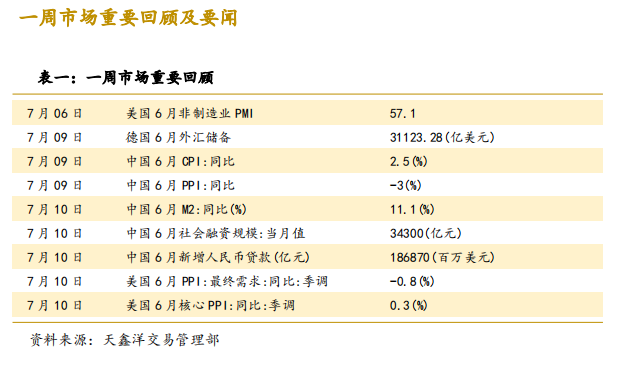

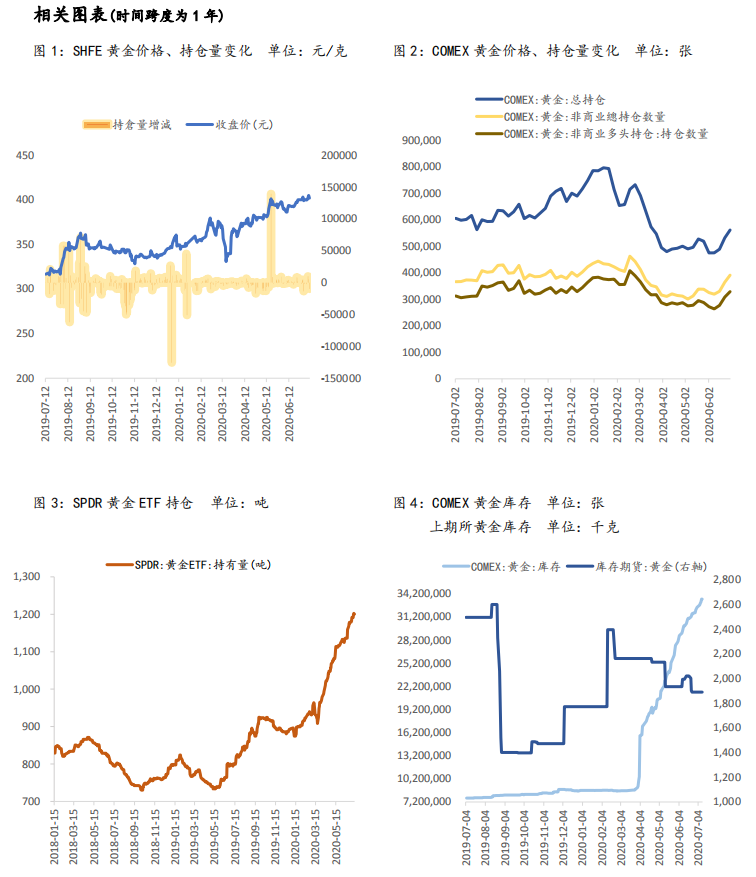

Gold rose last week, and London Gold has now closed at US$1798.30/ounce, with an amplitude of 2.74%, reaching a maximum of US$1818.14/ounce. The latest data released by the US Commodity Futures Trading Commission (CFTC) showed that COMEX gold non-commercial total holdings increased and net longs decreased. As of the week of June 30, non-commercial net longs decreased by 189,685 lots to 62,272 lots, a decrease of 75.28%, SPDR The recent holdings increased by 8.99 tons to 1,200.46 tons.

The price of gold soared last Wednesday and broke the important mark of US$1,800 per ounce, hitting the highest level since September 2011. As investors seek safe-haven amidst the spread of the new crown virus, central banks of various countries have launched strong stimulus measures to ease their economic impact. influences. The supporting pillars are fiscal and monetary stimulus measures, as well as the inflow of funds into gold-backed exchange-traded funds (ETFs) and other investments. Starting from the end of March 2020, the price of gold has steadily risen, which is also the time when the global epidemic has successively erupted. Global demand has plummeted, and high panic has promoted the inflow of safe-haven funds into safe-haven assets, gold and US dollars, and promoted the rise of safe-haven asset prices.

◆ Conclusions and suggestions:

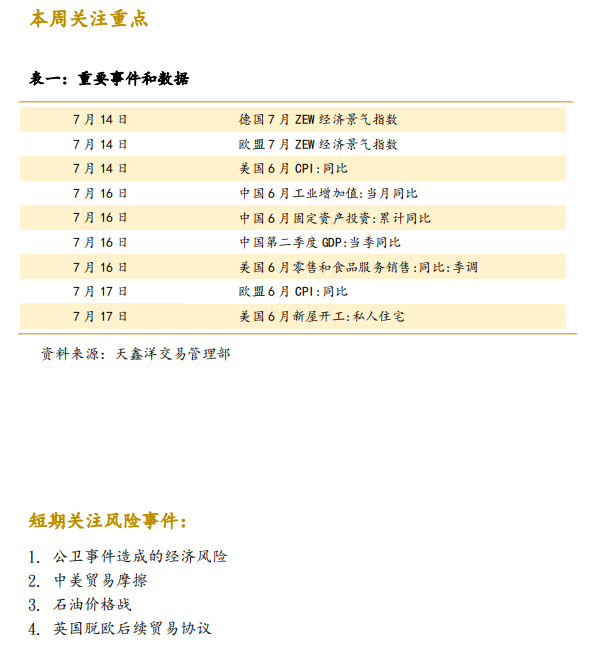

The current epidemic situation is still severe, but under the environment of abundant liquidity, the stock markets of the world's major economies have surged. Economic weakness and asset shortages coexist. In terms of data, US economic indicators have rebounded and the Fed has begun to shrink its balance sheet. China's economic growth and inflation data are also optimistic. Last week, the trend of precious metals rose and fell, and the bullish atmosphere still dominated. During the period, the market was concerned that the newly confirmed cases of the overseas epidemic continued to rise, and investors remained uncertain about the overseas economy. In particular, the risk aversion caused by the severity of the US epidemic overwhelmed its recent good performance in economic data. On the contrary, the domestic economy is recovering steadily, the stock market has risen strongly, the renminbi has risen against the US dollar, and the decline in the US dollar index has also boosted gold and silver.

Looking forward to next week, we need to pay attention to the progress of overseas epidemics. It is expected that the bulls of gold and silver will still dominate with the support of overseas epidemics that cannot be effectively controlled. The uncertainty of the epidemic still poses risks to the economy and financial system. Gold prices are expected to fluctuate around US$1,820/oz this week, and London gold is currently operating in the range of US$1785-1860/oz.

Market news last week

1. China's June M2 balance increased by 11.1% annually, in line with expectations

The central bank announced on Friday (10th) that at the end of June, the balance of broad money (M2) was 213.49 trillion yuan, an annual increase of 11.1%. The growth rate was the same as at the end of the previous month and was 2.6% higher than the same period last year, in line with market expectations. China’s new renminbi loans in June were 1,810 billion yuan, which is expected to be 1,800 billion yuan, and the previous value was 1,482.1 billion yuan; China’s social financing increase in June was 3,430 billion yuan, which is expected to be 3,050 billion yuan, and the previous value was 3,190.7 billion yuan.

The central bank pointed out that in the first half of the year, RMB loans increased by 12.09 trillion yuan, and foreign currency loans increased by 77.4 billion US dollars. In the first half of the year, foreign currency loans increased by US$77.4 billion, an increase of US$53.6 billion over the same period last year. In June, foreign currency loans increased by USD 15.4 billion and USD 23.4 billion.

2. The UK announces a new round of stimulus package with a scale of 30 billion pounds

The British Chancellor of the Exchequer Rishi Sunak announced the latest COVID-19 response plan on Wednesday (8th) to reduce the impact of the epidemic on the economy. In addition to reducing stamp duty and value-added tax, the stimulus package also provides incentives to employers who have not made layoffs in order to boost the job market. Sunak said that the British economy is facing severe challenges. In just two months, the British GDP has fallen by 25%, offsetting the accumulated output value in the past 18 years.

In addition, for restaurants, hotels, and tourism industries that have been more severely affected by the epidemic, the government also plans to implement a six-month value-added tax reduction, reducing the tax rate from 20% to 5%. It is expected that the total scale of this program will reach 4 billion pounds. In order to prevent the unemployment rate from rising, the British government began to implement an unpaid leave relief program in April, and guaranteed up to 12.1 million job vacancies. In the new round of stimulus plan, if the employer allows the unpaid leave employees to return to work and continue their appointment until the end of January next year, the government will give each employee a reward of 1,000 pounds (approximately US$1256). This plan is expected The total scale will reach 9 billion pounds (about 11.3 billion US dollars). The British government also plans to allocate 5 billion pounds for infrastructure spending, including schools, roads and hospitals.

3. Trump sends a letter to the United Nations, the United States officially withdraws from the World Health Organization

The US State Department and the United Nations said last Tuesday (7th) that the Trump administration has formally written to the UN Secretary-General Antonio Guterres, announcing that the United States has officially withdrawn from the World Health Organization (WHO), and on July 6, 2021 Effective. United Nations Secretary-General Spokesperson Stéphane Dujarric mentioned last Tuesday that the Trump administration sent a notice of withdrawal from the WHO to Secretary-General Guterres on Monday, and the United States will withdraw from the WHO within one year. The US State Department stated in an interview that the US will continue to seek reforms to the WHO. Robert Menendez, Chairman of the Foreign Affairs Committee of the US Senate, revealed on Tuesday that the US Congress has been notified that President Trump has officially withdrawn the United States from the WHO during the pandemic.

The United States has always been the largest donor of WHO, providing mandatory and voluntary contributions of between 400 million and 500 million U.S. dollars each year. At present, the United States still owes WHO approximately 200 million U.S. dollars in current and past dues. According to the withdrawal clause, the United States must first fulfill its financial obligations to WHO before it can formally confirm its withdrawal.

Wechat Public Account

Mobile Site

COPYRIGHT©2020 Chengdu Tianxinyang Gold Industry Co., Ltd. Power by 300.cn

川公网安备 51010502011525号