NEWS CENTER

2020-07-06 Golden Weekly Report Non-agricultural growth market is constantly worried, gold prices rebounded from previous decline

2020-07-06

◆ Content summary:

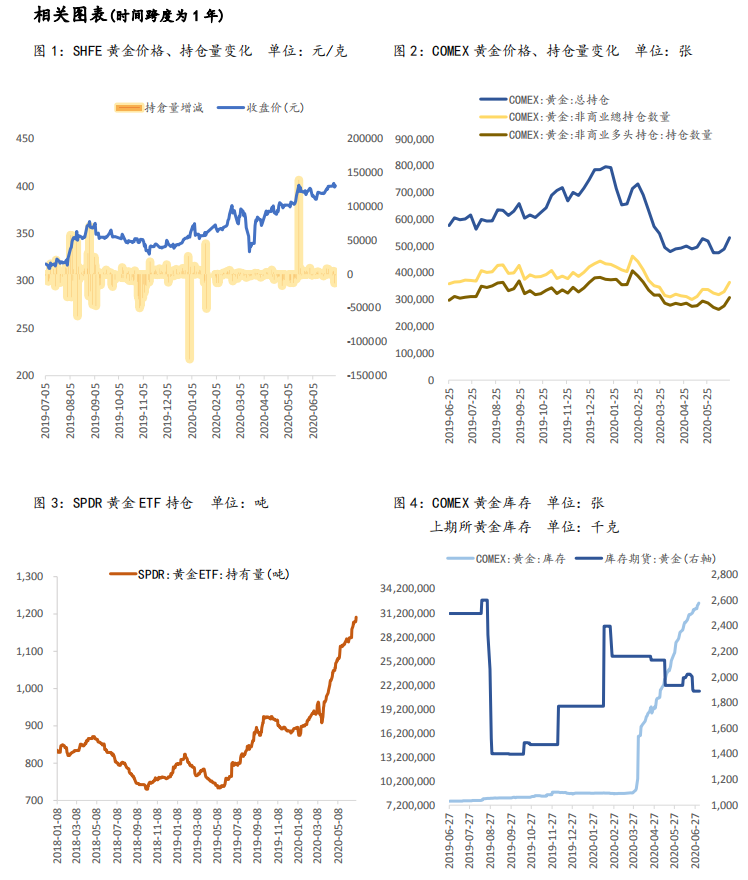

Last week, gold closed down slightly. London Gold now closed at US$1,774.31 per ounce, with an amplitude of 1.80%, with a minimum of US$1757.25 per ounce. SPDR's recent holdings increased by 12.57 tons to 1,191.47 tons.

Since the non-agricultural employment population increased by 4.8 million in June, it was the largest increase since the employment data began to be recorded in 1939. This made the price of gold intensified its decline and recorded an intraday low of US$1757.66. However, despite the two-month increase 7-figure employment opportunities, but this is not enough to offset the surprising number of unemployed workers still in trouble. Weekly unemployment data and the non-agricultural employment report released at the same time show that more than 19 million people continue to claim compensation. Since the coronavirus became synonymous with economic destruction, nearly 50 million people have applied for unemployment benefits. Economists pointed out on Thursday that so far, more than 30 million people still have no jobs. There are more than 50,000 new cases in a single day in the United States. People are still worried that the economy is not out of danger and the data is flawed. This rekindles risk aversion. In addition, non-agricultural data is basically the inertia of back and forth fluctuations, and finally promotes the rebound of gold prices. , And then recorded a daily high of US$1779.15 per ounce, and finally closed at US$1775.44.

◆ Conclusions and suggestions:

Taken together, U.S. non-agricultural data has been stronger than expected for two consecutive months, but there may be repetitions in the future. The reasons are as follows: First, the risk of the spread of the epidemic in the United States has risen again recently, and the number of new diagnoses in the southern and west coast provinces continues to rise, exceeding 10 Two states have announced the suspension of work resumption and opening up, and postponing resumption of work will have a drag on subsequent economic development; second, the recent marginal rebound in data has been partly driven by the return of the economy’s own trend, but the current level is still far from the potential output level before the epidemic, and the internal demand is restored It will still be premised on the epidemic being controlled.

The June ISM non-manufacturing PMI data will be released this week. Affected by the new crown epidemic, the U.S. ISM non-manufacturing PMI fell to 41.8 in April, the lowest since March 2009; the ISM non-manufacturing industry rebounded in May from April to 45.4, but it was still significantly below the 50 mark . The market currently predicts that the ISM non-manufacturing PMI in June will rise to the 50 mark, if the data is in line with expectations or better than expected, it is expected to boost confidence in the US economic recovery and suppress risk aversion; of course the influence of data May be weakened by the new crown epidemic. The price of gold is expected to fluctuate around US$1790/oz this week, and London gold is currently operating in the range of US$1730-1820/oz.

Market news last week

1. U.S. non-agricultural rebound

In June, the number of non-agricultural employment in the United States increased by 4.8 million, the largest increase in history. The recovery for two consecutive months confirmed the positive promotion of the resumption of work to the economy. On the evening of July 2nd, Beijing time, the US non-agricultural data released in June. The number of non-agricultural employment increased by 4.8 million in June. The unemployment rate fell to 11.1% and the previous value was 13.3%. After May, it once again exceeded market expectations. Although the current non-agricultural data may not fully reflect the employment situation due to statistical calibers and other issues, the trend of the US job market rebounding from the bottom of April is basically established. This shows that the resumption of work in the US since May has positively promoted employment and the economy. .

In terms of labor participation rate, the labor participation rate in the United States rebounded to 61.5% in June, which was 60.8% from the previous value. The labor force increased by 1.71 million that month. The work-age workers who voluntarily withdrew from the labor market in the early stage are gradually returning, but the current absolute value is still relatively low. There is a certain gap between the level of more than 63% before the outbreak. From the structural point of view, the proportion of newly added services in the service industry has increased, and the restoration of the manufacturing industry has also accelerated: the construction industry has increased employment by 158,000 in a single month, with the previous value of 453,000, and the employment-side restoration has slowed down; the durable goods manufacturing industry has increased employment29 The previous value was 153,000. The non-durable goods manufacturing industry increased employment by 66,000 and the previous value was 97,000. The increase in manufacturing employment increased from the previous month. In addition to the impact of the resumption of work, it may also be affected by the recent marginal recovery of US auto sales. drive. The service industry as a whole added 4.263 million jobs in a single month, with a previous value of 2.548 million. Among them, the leisure and hotel industry and the retail industry increased significantly, and the increase in the single month increased significantly compared with the previous month. The drive is stronger.

The total working hours have dropped and the hourly wage growth rate has turned negative. This shows that low-income workers have rejoined the job market and the overall employment structure has tended to be healthy. In June, the average weekly working hours of all non-agricultural enterprises in the United States was 34.5 hours, a decrease of 0.2 hours from the previous month. Among them, the manufacturing hours rebounded by 0.5 hours from the previous month, and the service industry hours fell by 0.2 hours from the previous month. This was mainly driven by the sharp increase in service industry employment; The growth rate of 5% and the year-on-year growth rate of total weekly wages of 5.3% have declined, while the hourly wage growth rate of -1.2% from the previous quarter, including -1.3% of the hourly wages in the service industry and -1.7% of the weekly wages all show that the average salary is So down. The non-agricultural data in the United States for two consecutive months showed a trend of "significant increase in employment + month-on-month salary decline", which shows that low-income workers are gradually returning to the job market, and this trend often corresponds to the continued recovery of economic prosperity.

Wechat Public Account

Mobile Site

COPYRIGHT©2020 Chengdu Tianxinyang Gold Industry Co., Ltd. Power by 300.cn

川公网安备 51010502011525号